Increase online banking loan applications with compliant co-browsing technology

On the banking app Revolut, customers can get an online banking loan in minutes. The same goes for N26, another fast-growing fintech that allows customers to get a personal loan of up to €25000 directly into their N26 account with minimal paperwork and a secure digital signature.

According to McKinsey, “71% of consumers today prefer multichannel interactions and 25% express a desire for a fully digitally enabled private banking journey with remote human assistance when needed.”

Customers today are looking for a truly omnichannel banking experience. Digital tools that enable companies to interact and collaborate with customers remotely are now a key element of the digital transformation goals for modern banking and financial services institutions.

When it comes to digital loan applications, customers are looking for a quick and hassle-free omnichannel journey, with the ability to quickly reach out to an advisor remotely when they require assistance at any point during their online banking journey.

The co-browsing impact on loan applications (FYI, screensharing is a bad idea)

Co-browsing technology was built for these situations, and world-leading insurance companies like AXA are already using Surfly Co-browsing technology to remotely connect thousands of agents to customers and seamlessly complete policies with a substantially shorter sales cycle.

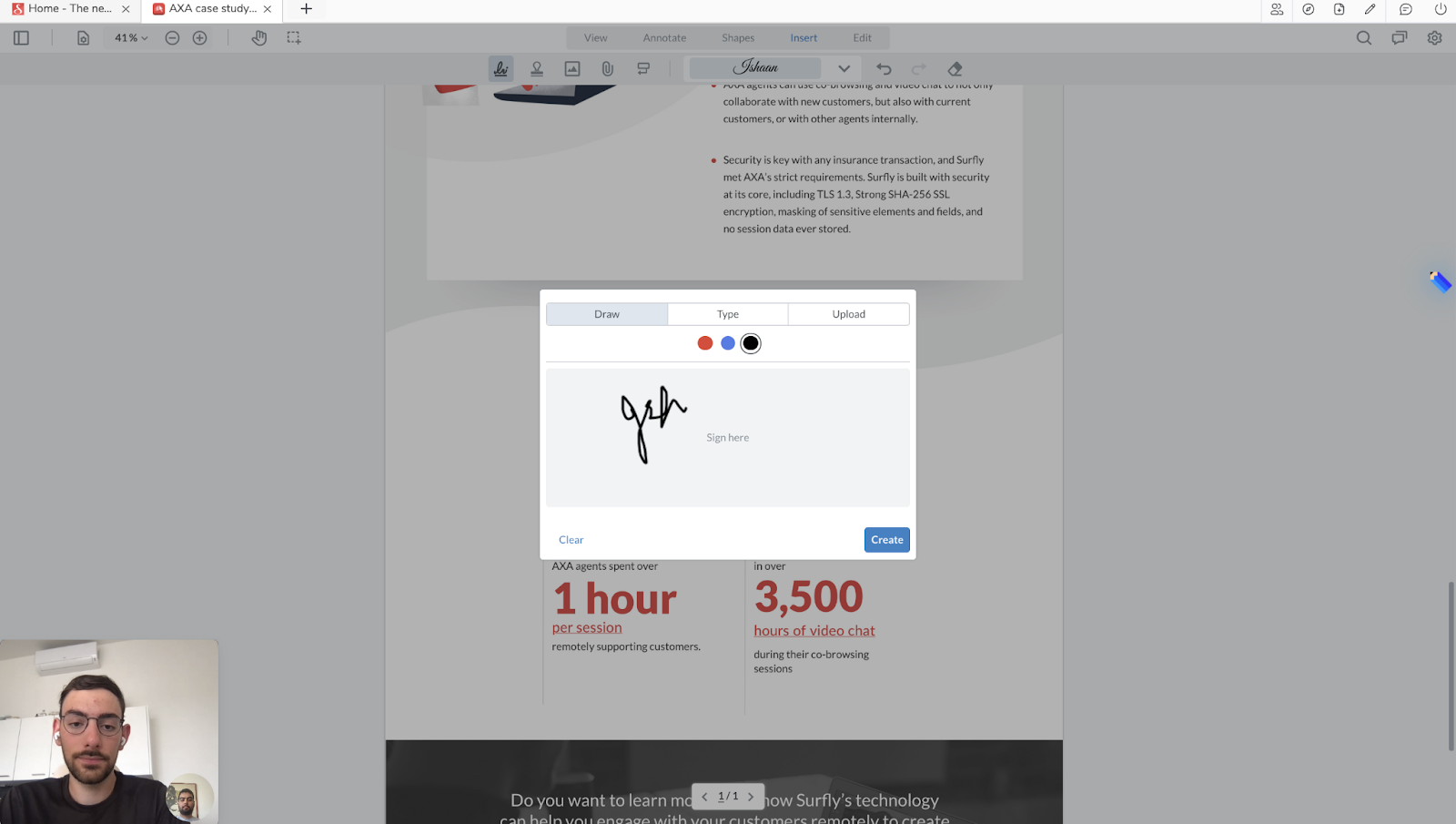

Simply put, co-browsing technology allows you to view the browser screen of your customer and guide them through the loan process. However, Surfly Co-browsing takes it one step further: we also allow you to video chat and upload & e-sign documents on your own platform. This allows your loan advisors to first build trust with the customer, guide them through the entire loan application process, and finally complete the entire loan application, all within the same session.

This happens on your own platform and eliminates dependence on third-party applications like Zoom and Docusign. In fact, screensharing tools like Zoom are a compliance nightmare and fail to address the security challenges that remote support and collaboration bring.

Surfly works with existing customer journeys and technology investments

Perhaps the single most important thing to remember about Surfly Co-browsing is that it complements your existing customer journey with little to no changes required in your existing tech stack. This is because the in-house technology powering Surfly, The Interaction Middleware, is a plug-and-play technology that works out of the box with any content on the web.

Let’s review a few scenarios to see how it can help your company’s specific use case:

- Inbound call: If a customer calls your loan advisor to understand the different loan products, you can upgrade the phone conversation to a visual and collaborative co-browsing session. There are 2 ways to do this:

- Your advisor can send a secure co-browsing link to your customer with your existing communication channels (SMS, Email, Whatsapp, etc.)

- Your customer clicks a “Get Help” button on your website, and a co-browsing session begins instantly with the loan advisor

- Inbound chat: If a customer uses your support chat, a Surfly Co-browsing session can be started by sending a link on the chat or pressing a specific button to “Get Live Help”

- Outbound call: If a customer has scheduled a call with you, you can simply send them a link that will start the co-Browsing session.

Surfly Co-browsing works with the existing customer journeys of all major banks

A personalized experience that builds trust with the customer

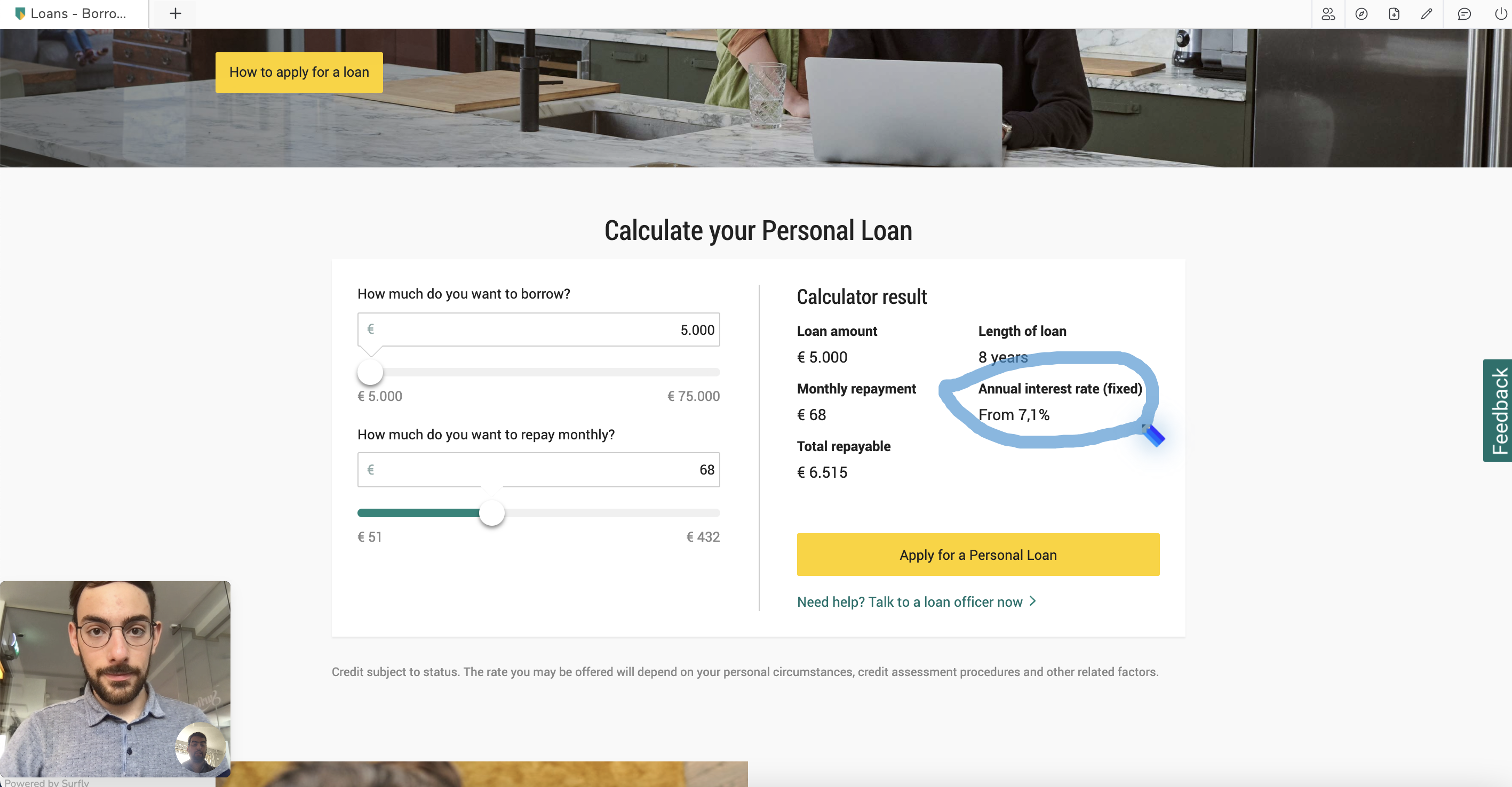

Once your loan advisor and the customer are in a Surfly Co-browsing session, the entire loan application process can be completed in 2 simple steps:

- Guide the customer: Use the co-browsing and video chat tools to actively collaborate with your customer and guide them through the entire process in real-time with an experience that mimics the in-person banking experience.

- Upload documents and e-sign securely: Surfly allows you to upload any necessary documents and edit or annotate them to complete all required fields. Finally, you can securely e-sign them on your own platform, and finalize the loan application in the same session.

Stay 100% secure and compliant

Surfly also enables you to be fully compliant while having a visual and active interaction with your customers. If an agent is helping a customer fill out a form or sign a document, having a record of who performed what action is crucial for reporting and compliance. Surfly comes with detailed audit logs, so you always have full insight into everything that happened in a session.

However, to make sure that session interactions remain 100% secure, we never store any data on our servers. The entire Surfly Session has been designed to act as a transparent middleware layer, with information only passing through but never stored. And when no data is stored, no data can be lost. Additionally, with in-session masking features like field and element masking, your advisors will never see sensitive customer information.

Multiply loan applications with personalized online banking

In conclusion, Surfly Co-browsing transforms your existing platform into a visual and collaborative platform that enables you to connect with your customers on a personal level even while being remote. Since the entire process happens on your own platform, you become independent of third-party screensharing or collaboration tools, and customers feel safe while making important life decisions with your company. This leads to a shorter sales cycle and a higher number of finalized loan applications.