How co-browsing can help your customers to pick life insurance remotely

Co-browsing, or browsing remotely in a single tab together, gives insurance agents the tools they need to deliver powerful digital CX and close deals even when they’re not physically present to guide customers.

Surfly’s robust APIs can live within any technical environment that your agents use, whether it’s a Contact Centre Platform, CRM tool, or even a chatbot integration. The API Documentation is so easy to implement that we onboarded 1000 agents for AXA Singapore in under a week.

Humanize your digital CX with Surfly’s co-browsing

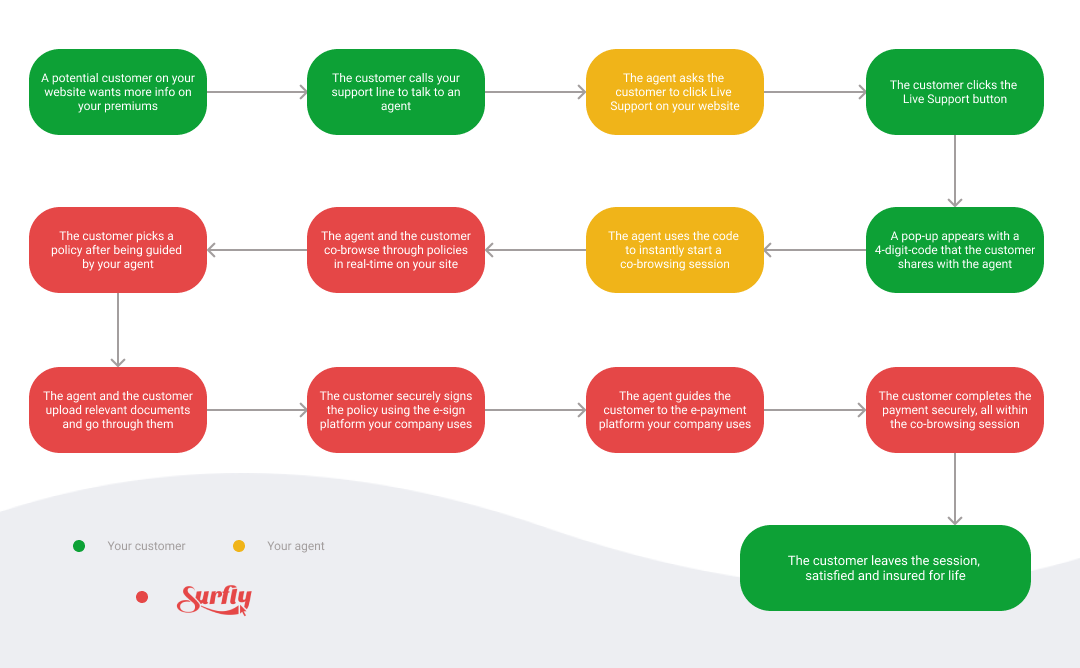

There are two ways that your agents can use co-browsing to help customers choose the right insurance policy for themselves. We call these ways ‘flows’, and the two available flows are ‘inbound’ and ‘outbound.’

Inbound flow: the customer asks the agent to start a co-browsing session.

Outbound flow: the agent asks the customer if they want to start a co-browsing session.

Although Surfly is a co-browsing solution, that’s not the only feature we offer. Here are some of the additional benefits of using Surfly to guide customers through available policies.

Enable agents and customers to collaborate as if they’re sitting side-by-side

Video and voice chat

Your agents can use Surfly’s video chat functionality with co-browsing to connect more personally with customers, recreating the feeling of meeting in person while being remote.

Control switching

Your agents and customers can switch control back and forth between them, allowing one person to control the session at a time.

This means the ‘leader’ of the session can navigate through different pages, while the ‘follower’ can highlight points of confusion using Surfly’s built-in Drawing tool.

File sharing

Your agents and customers can both share files from their own devices during a co-browsing session. All they have to do is upload the document to view it in a separate tab of the session.

This also means your agents can move from page to page of any document in real-time, highlighting and explaining every part to your customers.

E-signing compatibility*

Surfly works with almost all e-signing platforms, which means your agents can guide customers through the entire process of signing a policy without needing to leave the session, or courier documents back and forth to finalize the policy.

*Surfly uses a unique low-latency approach to document signing, which means no lag and no load times. Signing is instant, so you and your customers won’t have to wait to see your signatures appear.

Protect customer data and comply with industry security standards

Field and element masking

Remain compliant with industry security standards by masking selected fields so that your agents can only see the information they need to process the policy.

This means you choose which fields your agents can see, so that your customers’ SSNs, credit card details, etc. will stay private to your customers. This is part of Surfly’s commitment to data privacy, wherein we believe you and your customers own your data, not us.

White & black listing

You can set different permission levels for different members of your organization, so that you control who has access to functionalities within Surfly.

This means that your managers and agents will have different tools available within Surfly. For example, you can set it so that your managers can access audit logs for all agents, while your agents can only see their own.

Use audit logs and session data to optimize customer experience

Built-in reporting tool

Surfly’s audit log gives you an in-depth overview of session actions and results, which you can use to track how your agents are using Surfly.

Customizable UI

The information in the audit log also helps you to make tweaks and changes to our customizable UI according to your own customers’ preferences, allowing you to deliver an experience that will keep your customers engaged for life.

To learn more about Surfly’s intuitive features and how we can help you serve customers with our powerful co-browsing technology, visit our website or contact us.