How co-browsing complements and supports changing business strategies in the Banking Industry

(This is the third and final blog in a series of guest posts by Jacqueline Mundkur, a CX practitioner with deep experience across retail, telecom, logistics and CPG verticals. She is Founder & CEO The Nxt Levels CX consultancy. Here you can read the second post on how Insurers Use Co-browsing for both CX and Security Goals while Increasing Conversions)

More than a year on, the pandemic continues to cast its long shadow, globally forcing a reset of practices in almost every sphere of life. In industry, examples of directional changes are evident as investments and strategies start reflecting changes in customer attitudes and behaviours.

In this article, we highlight a recent development in the banking industry, where major players of the banking industry in India are observed to be ‘rationalising’ (in other words, reducing) their network of physical bank branches.

This move has been further accelerated in the face of COVID restrictions, deep penetration of smartphones, and the sheer pervasiveness of digital solutions.

Prior to the execution of any new strategy in the banking industry, a thorough impact analysis and scenario testing is conducted. These evaluate the implications of the strategy on revenue, profitability, customer satisfaction, and loyalty . Since reducing physical access points can certainly have a customer impact, any customer-focused organisation is compelled to proactively control any negative fallout on its two most important stakeholders: employees and customers. For instance, post pandemic, initiatives have been directed towards increasing employee empowerment to enhance their ability to resolve issues while operating from home as easily as if they were servicing the customer’s needs from a retail branch or on the field. This meant that providing data access and real-time information, commensurate with employee roles and responsibilities got priority and increased employee effectiveness. And for their customers, banks opened up more and more digital-powered self-help options in order to ameliorate the need of a customer to walk-in and easily access its services from anywhere.

From the CX perspective, these are great initiatives as they easily fulfill specific customer needs. However, retail banking managers speak about how physical walk-ins also provide the catalyst for cross-selling and upselling opportunities, tapping needs that perhaps the customer is not consciously aware of. Branch personnel interact and engage personally with the customer before recommending solutions. This in-depth, human conversation helps build a rapport and allows the two individuals to build trust. This direct interaction lies at the heart of service differentiation. To prevent missing out on such opportunities in this virtual world, co-browsing technology is a great add-on to enhance the quality of customer experience, build trust, and fulfill organisational goals.

The beauty of co-browsing is that it serves the purpose of both key cohorts: customers and employees. Employees in a co-browsing session can converse, probe and promote products and services while solving specific customer needs. On the other hand, customers can be assured that they can almost replicate the physical interaction securely from the comfort of their homes.

Necessity has driven certain older demographics to adopt virtual services. However, enough insights indicate that a large enough segment still prefers direct interactions with a live agent; a need that can be catered to by co-browsing. The added benefit is that for an intensely regulated industry like the banking industry, the security aspects can also be well taken care of. So, how does this technology work?

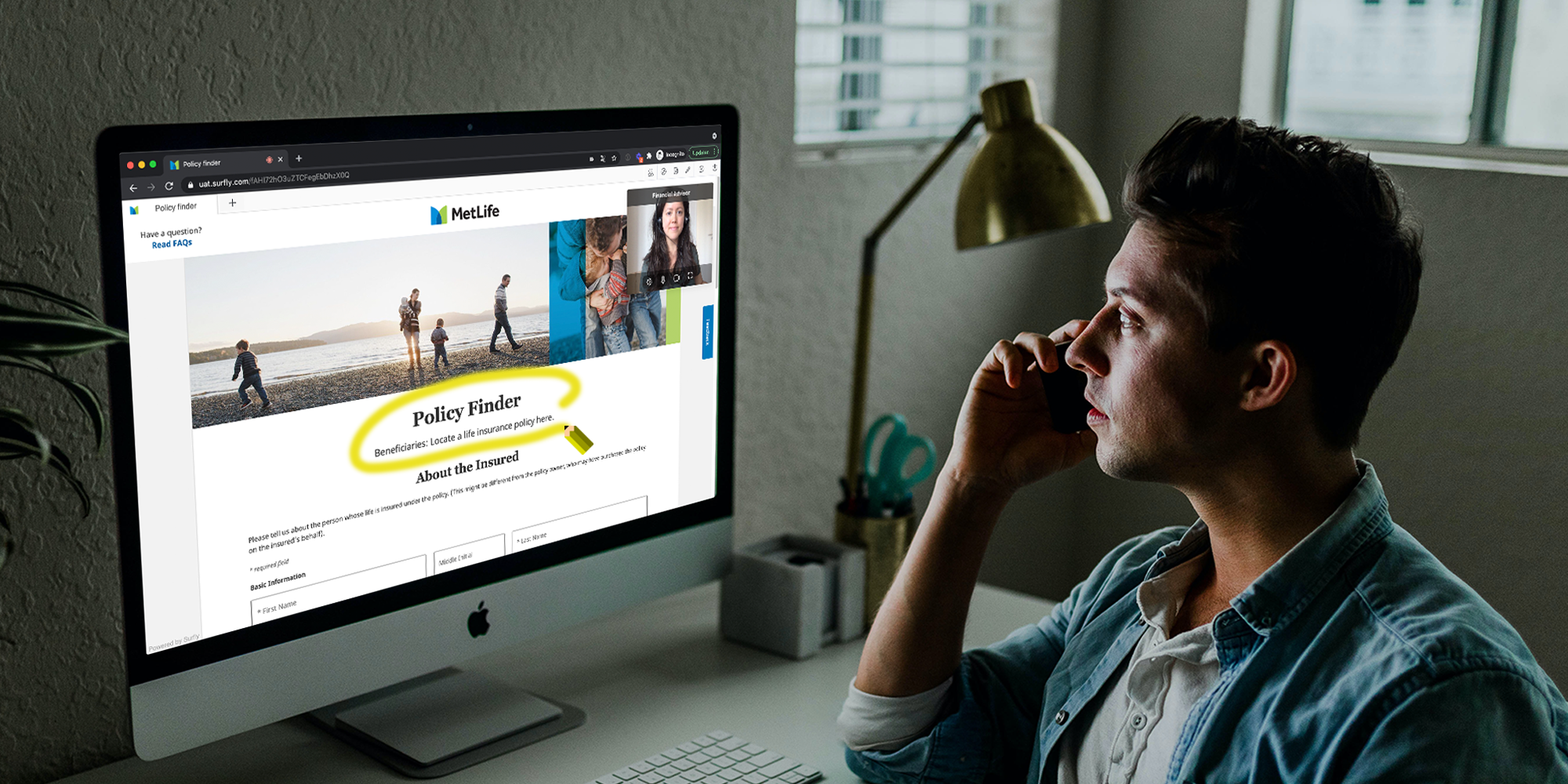

Simply put, co-browsing or collaborative browsing can be enabled by a simple help button on a website to help a customer to reach out directly to a banking advisor even midway while on a call or via an assisted chat conversation. This can also happen when the customer is struggling to navigate through relevant pages on the site, has a ‘what if’ moment, or requires clarifications. In geographies where prospects or customers have varying degrees of literacy, co-browsing brings relief to those who are not comfortable with the written word and prefer stepwise guidance.

Co-browsing can also be a boon especially in scenarios when a customer has started a chat or is on a call with the banking advisor, but is not making much headway, prompting the advisor to direct them to the help button. By inputting the 4-digit code that appears, both of them can enter into a co-browsing session continuing the conversation seamlessly. An advisor can also set up an appointment with the prospect by sending a link to the co-browsing session. This session can be conducted either over voice or video where both prospect and advisor can progress together in tandem through either sales or service journeys. These might include understanding details of the product, choosing options that fit the customer’s need, signing documents, etc. But that’s not all! In fact, you can even make the 1st deposit with Surfly’s co-browsing session, thus closing the loop successfully. And, all this happens in the confines of the customer’s home/ office using the same browser tab of the co-browsing session.

Since co-browsing enables both the customer and banking advisor to see the same screens, it cuts through frustrating communication gaps and navigational challenges.

A full audit log of the session of each interaction can be made available. Each action that either party takes can be recorded, fulfilling the necessity from a regulatory and fraud perspective. Based on a customer’s request, controls can be also effortlessly switched between the customer and the advisor. At the customer’s request, a transcript or even an image on email can be sent. Easy integration with CRM or such tools to derive analytics for more customised offerings are an added advantage.

Apart from facilitating synergistic work between operating teams and HR to reskill the frontline, the service ensures easy integration as it can be enabled and made live on the website with minimum fuss. This makes Surfly’s co-browsing the go-to technology especially since it promises a drop in cost and closure time of acquisition for the service provider. Co-browsing technology, especially by Surfly, opens up ‘insta-start’ possibilities. It needs no integration since it is a browser-based technology and doesn’t need any preinstallation, configuration, or installation of software. What’s more is that Surfly is also device and browser agnostic and works easily with existing tools or digital channels.

Technology-based creative innovation is making its mark almost everywhere. Adopting co-browsing certainly helps in cementing potential business opportunities by skilfully marrying the traditional with the new, or the physical with the virtual while employing a powerful customer-centric lens.