How Co-Browsing Addresses Covid-19 Related Security Challenges

As businesses move online and adopt remote work, different industries face different challenges. For some businesses, it’s harder than others. A brick-and-mortar store can use plugins to set up an online store. A clothing brand can try virtual fitting rooms.

But banks and insurers are a little different

For industries facing substantial security threats, going remote can be tricky. Banks and insurers are massive targets for fraud.

With greater security risks and customer’s life savings and most private information at stake, banking and insurance are held to the highest standards of compliance under the law. A bank’s online tools must be totally secure and guarantee compliance to protect all parties involved. Seriously, no pressure.

New Normal, Fresh Security Issues

As businesses move online, cybercriminals see new opportunities.

The fraud epidemic

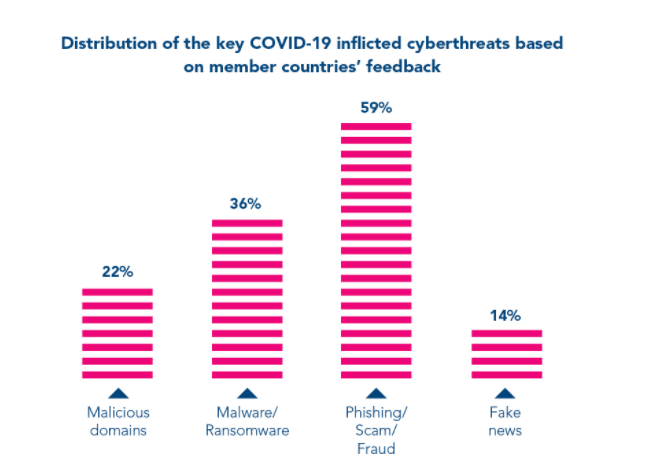

This year cyber fraud has been an epidemic of its own. The numbers are shocking.

- Phishing and cyber scams are up 59% according to INTERPOL. Bank fraud is among the fastest-growing scams of this kind.

- 43% of financial institutions have said that going remote has made them less secure. (Source).

INTERPOL’s Secretary General Jürgen Stock warns,

“Cybercriminals are developing and boosting their attacks at an alarming pace, exploiting the fear and uncertainty caused by the unstable social and economic situation created by COVID-19.”

Customers care about security

The majority of customers polled (54%) said they believed it was the financial institution’s job to protect them from cybercrime.

80% said protection from cyber crime would influence their decision to change or choose a financial institution.

Co-Browsing’s got you covered

The good news is that the fundamentals of customer-facing cybersecurity are simple. It all comes down to knowing your customer is real and letting them know you are real. Co-browsing helps you meet both of these requirements for a safe and secure remote experience.

Co-Browsing vs. Screensharing

Anyone who knows a thing or two about cybersecurity knows that the words “screensharing and “secure” don’t belong in the same sentence.

We’ve covered the many ways in which co-browsing outperforms screensharing. Co-browsing is faster, has lower latency, and doesn’t interfere with the quality of your browsing experience. We could go on and on.

Screen sharing leaves nothing to the imagination

Security-wise, screensharing has one fatal flaw: it lets the person or business you’re sharing with see everything.

Once to opt to share your screen, whatever is on there becomes visible to everyone on the call.

Now, you might be saying, “But I’m careful and close all my really messed-up tabs before I screen-share.” Fair enough, but if you’re using screensharing for something sensitive like filling out banking details, you have no way of hiding personal info like your Social Security number from the person on the other end of the call.

Not only is that sort of thing unsafe, compliance regulations usually prohibit financial institutions and insurers from doing it.

Co-Browsing has Security Baked-In

Co-Browsing in general, and Surfly in particular

Surfly’s security features address compliance issues and use masking to allow users to protect their own privacy.

Compliance Features

Surfly helps insurers and financial institutions work with customers remotely while staying compliant.

We make it possible to choose and sign a policy and make their first payment in a secure co-browsing session that adheres to industry regulations and privacy standards.

Since Surfly is a middleware solution, not software, you can use it with your existing tech stack and privacy tools. Neither the business or the customer has to download anything or interact with third-party technology that could pose a security risk.

Audit logs

To stay compliant, insurance companies need to have a log of interactions proving that the client themself signed the documents and not some other party. Surfly’s audit log feature keeps track of this (on the company’s servers, not ours) in case they need to audit the documents.

Masking

Masking features let users hide sensitive info like account numbers, addresses, and Social Security numbers. The agent they’re co-browsing with sees only what they need to see to complete the transaction.

Surfly never sees or stores your data

Never. Ever.

Trust is a Must-Have

Customers want a secure browsing experience. Regulators require compliance with security rules.

The need for secure online tools is higher than ever as cybercrooks take advantage of the global crisis and our shift to remote work.

Trust is non-negotiable, especially in banking and insurance. Surfly helps you earn it.

Stay secure and compliant with Surfly